Credit Score Range For Car Lease

No matter how terrible your credit score is within reason of course you ll probably be able to find someone who s willing to lease you a car the real questions are whether the lease rate they ll offer you will be worth it and whether leasing a vehicle is a good personal investment over the long term even if it s generally cheaper than buying a car.

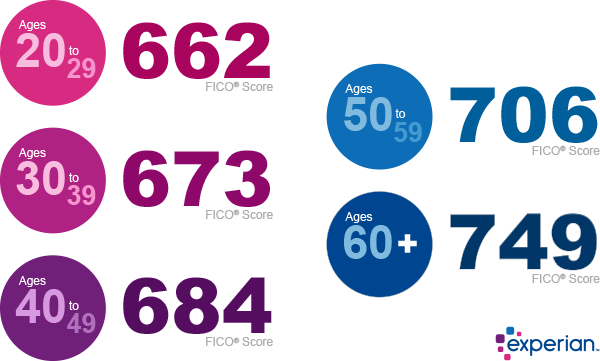

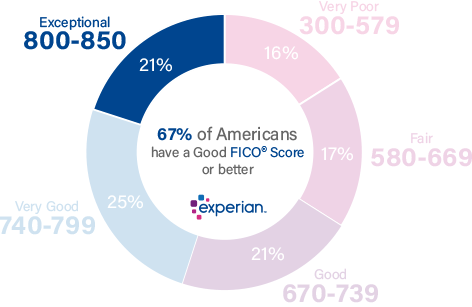

Credit score range for car lease. The typical minimum score for a lease agreement with a reputable dealer is 620. People leasing a new vehicle have an average credit score of 724 according to experian data from the fourth quarter of 2018. Before you seek out a car lease check your credit score and see how lenders and leasing companies are likely to interpret it. You ll typically need good credit to lease a new car.

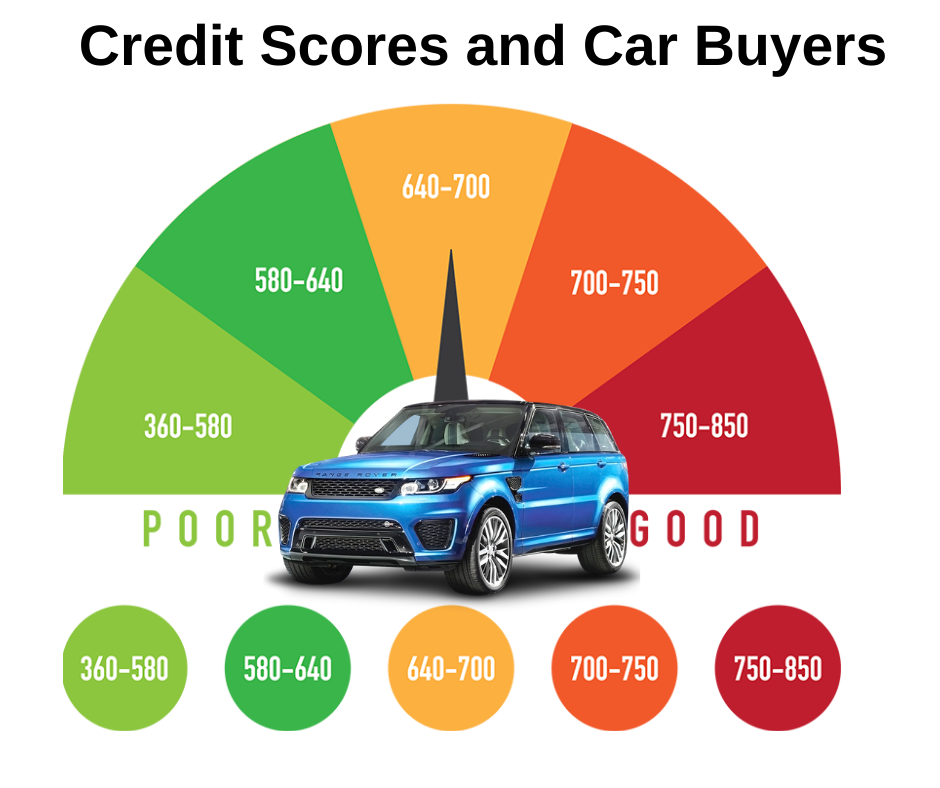

Having a higher credit score qualifies you for a lower interest rate which translates to a lower monthly payment. Auto lenders and lessors examine your credit scores when determining the interest rate on your loan or lease. The benefit of a lease is that you can get a new car more quickly and can end up with a great credit score and report if you pay on time. A credit score that s good enough to get you an auto loan may not be high enough to get you a decent deal on a lease.

Fico considers scores above 700 to be good keep in mind that even though you don t own the car you re leasing your lease payment history will show up on. So what score do i need. A score between 620 and 679 is near. Credit scores and car leasing.

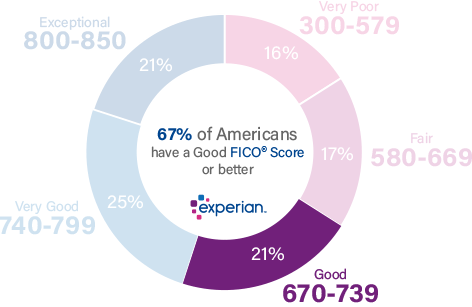

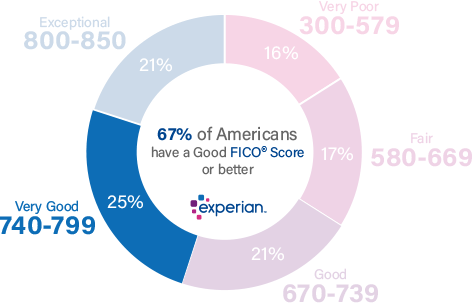

In general leasing a car requires you to have an excellent credit score. Auto loans and leasing are both installment loans a type of loan with a set monthly payment over a set period of time. These are some important things you might want to consider before signing a lease. According to experian leasing companies typically look for fico scores of 700 or better on a scale with a range between 300 and 850 which fico regards as a good credit score.

A lease can improve your credit score if handled correctly that is. If you know that leasing could be right for you after researching the requirements that come with leasing a car make sure to arm yourself with common leasing. However the exact impact depends on a variety of factors. Auto leasing companies typically look for fico scores of 700 or better which fall solidly within the ranks of what fico regards as good credit scores.

Having a good credit score is important when you buy a car but it is critical when you want to lease a vehicle. Installments loans can really help build a good credit score because they. Your credit score ranges from 300 to 850. If you re looking to improve your credit score by leasing a car good news.

According to nerdwallet the exact credit score you need to lease a car varies from dealership to dealership.

/FICO-Scores-0474cc0ca87b4b58b9391f065f623c0f.jpg)